Short and Long-term Financial Commitments

When looking at where you want to go for college, what you want to study,

what activities you want to get involved in, one thing constantly pops up:

money – and how you are going to pay for preparing for your future. This is a

new concept to many, including me, when coming to college. The luxury of free

education has expired and one must now be able to find one way or another to

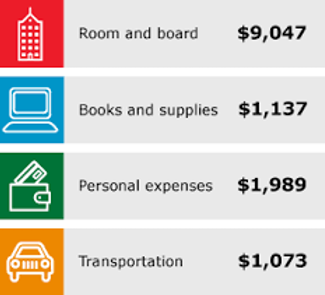

financially support their studies. Along with the overwhelming tuition, room

and board, and class fees comes the shocking rice of the required textbooks.

Because of this, money is also a driving factor in which direction students

choose when purchasing their materials for the semester. In this section,

we will discuss the differences between the short and long-term financial

commitments that coincide with each text option, as well as put real

numbers to the options.

To differentiate the different types of costs incorporated into buying the

required materials, this page breaks them into short and long-term financial

commitments. Short term commitments are things that students need to buy

on a semester basis. They do not require much, if any, financial attention after

the initial purchase of the resource, however, students are faced these costs

at the beginning of every semester. Long-term financial commitments may require some type of maintenance, whether to function properly or to keep up to date. Although these things often require more than one withdraw from an account, they tend to have a longer life span that just a semester. In the following section, we will look at what the financial commitments are to each format when purchasing.

It is important to remember that the financial commitment to school every semester is not based solely on what type of book you choose to learn from. Costs may vary greatly depending on the level of class you are taking, the subject field and the type of book required (i.e. a textbook, versus a shorter fiction or nonfiction novel).

Financials of eTextbooks

The financials associated with eTexts can easily be much more complicated than its hardcopy counterpart. In order to have access to the eTexts, one must have an up to date and compatible electronic device. This mean spending as much as over a thousand dollars on one computer, and that’s before any of the books are bought. Thankfully, with the world evolving to electronics in many aspects, multiple modern day students already have a computer that is compatible with these books. However, the added costs that come with the maintenance of these computers do add up. Whether it is a plug in that needs to be purchased so the images on the textbook are visible, access to a certain subscription service, paying for internet when off campus, as well as electricity needed to charge the device. These are all things that require continual attention throughout the semester and are not one-and-done short term commitments. It is important to remember many times students are paying this in order to upkeep their device despite what method they use in school, however these expenses are of greater relevance and importance when they can effect a student’s access to their book.

ETexts do come with short term financial commitments as well, such as the purchasing of the textbook. Many times, when purchasing a book online it is formatted the same as a subscription to the text, or the equivalent of renting a hardcopy book. Although many times it’s not specified, the text access may last only until the end of the semester.

Financials of Traditional Textbooks

The purchasing of hardcopy, traditional textbooks typically incorporates only a short term financial commitment. Physical textbooks do not require any maintenance or updates once purchased, all that is required is to keep the book in good, functioning condition in order to be able to use it properly.

Also, there are ways to make some money back on these resources! If you choose to purchase a hard copy of a book, there are often bookstores around your town or on campus that will buy back the book for a reduced price, a great way to make up some of the expenses that come with purchasing hundreds of dollars of books!

A Semester of Books: Megan Pannell

In order to put what I am saying into a real life, real time example,

I am using my fall semester of classes as an outline of a semester’s cost in

books. Below is a list of my fall 2016 courses, and the prices of my books

required for that class categorized by their format. In this table, courses

which did not have an electronic option in the reading material are

identified with an asterisk at the end of the title.

In the table, the cheaper option when concerning only the short term financials is definitely the eText format. However, one always has to take account for the different expenses that come with the electronic aspect. One of the best things about having multiple options available when looking at formats is that you can mix and match so you are able to choose the ones that cater your needs the best! There is no rule that requires students to only choose one if both are readily available at your institution.